The typical commentary surrounding Australian property in the past 12 months has been that residential prices have been growing despite the pandemic, but, is this the case? Or are the unique circumstances surrounding unparalleled Government support & schemes, record low interest rates, and further economic stimulus driving the housing economy to be healthier than it ever would have been without the tragedy of the COVID-19 pandemic.

A recent study by the KPMG Economics Group looked to delve further into this hypothesis, seeking to understand whether the pandemic has led to residential property prices being higher than would have been the case otherwise.

To give you a bit of background, the general consensus from industry commentators was that housing prices in most capital cities across the nation would enter a cyclical upswing at the commencement of 2020, a trend that was only falsified by the onset of the pandemic causing a national lockdown at the start of the year, leading all capital cities, except for Canberra, to contract during the June quarter.

A range of both direct, and indirect policy responses alleviated the uncertainty that clouded the property market in a world overshadowed by impending lockdowns fundamentally changing the way we live, and since then, we have experienced record levels of growth.

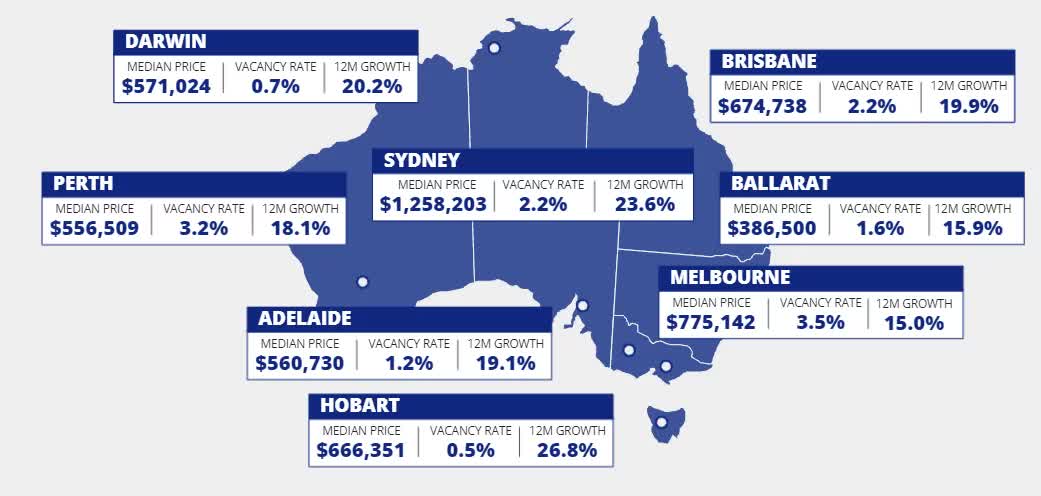

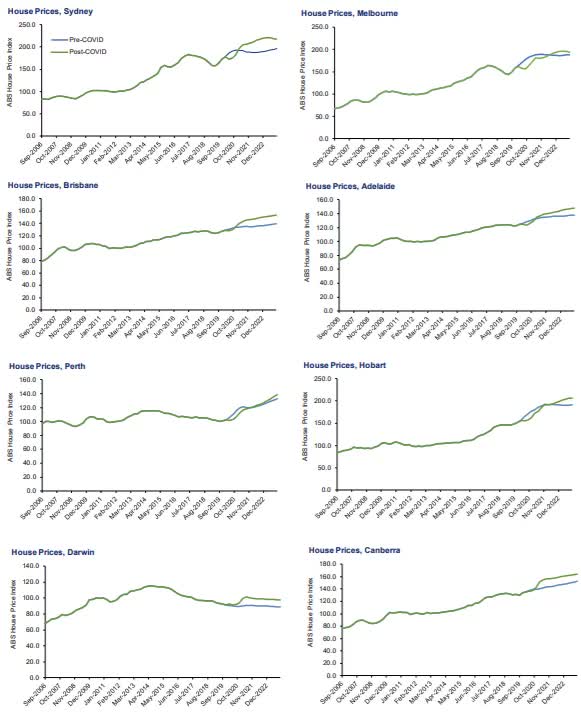

Our education team has constructed this graph below, which shows the incredible growth seen across every capital city in the past 12 months.

In terms of basic economic principles, the housing market works as any other fundamental market does, price lies where demand meets supply. In the case of the property market, that is, where housing stock and population meet. Although, there are short term factors that can cause the market equilibrium to deviate from the point of long-run equilibrium, factors such as interest rates or investor share.

At this level, rises in residential property prices have been greater than what was estimated in a counterfactual “no-COVID” scenario. The short term influence of intervention via both the Commonwealth Government and the Reserve Bank of Australia (RBA) has buoyed the market to a point of strength, leveraging the benefits of schemes such as the HomeBuilder program, and more widespread changes to monetary policy settings.

The report from KMPG used economic modelling to indicate the predicted property price growth in the no-COVID scenario, i.e. where the market would be without these aforementioned impacts. This is achieved through using pre-pandemic forecasts regarding the estimated population growth and other exogenous variables (such as interest rates).

The stark dichotomy of our reality can be compared by breaking down these lower pre-COVID estimations in opposition with where we sit today.

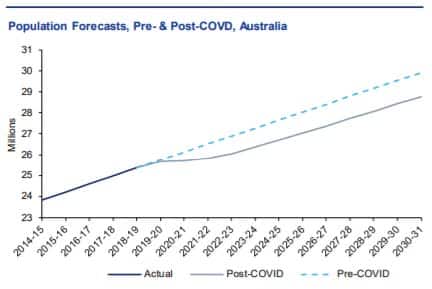

Let’s start with population.

The projected population is estimated to be 1.11 million less than it would have been without the COVID-19 pandemic, as the impact of the pause on immigration is felt across the nation, and the lingering effects of border controls & international travel restrictions likely to hold the population boom for a little longer.

Victoria and New South Wales are predicted to be hit the hardest by the change in population forecast, whilst states such as Tasmania and the ACT are likely to be the least impacted, as evidenced on the below graph.

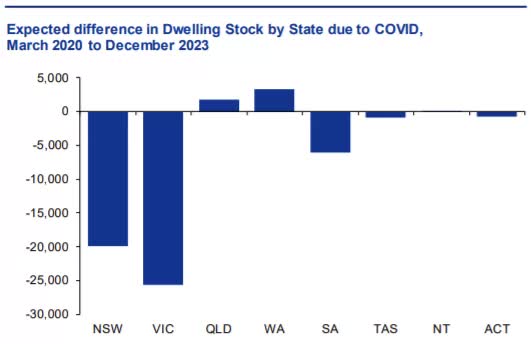

Another key change to analyse is the expected difference in dwelling stock by State, up until December 2023.

Victoria and New South Wales are expected to be the harshest hit, with Victoria expected to be approximately 25,000 lower, and New South Wales 20,000. Conversely, Queensland and Western Australia are likely to see an increase in dwelling stocks, buoyed by the positive net interstate migration that they have experienced.

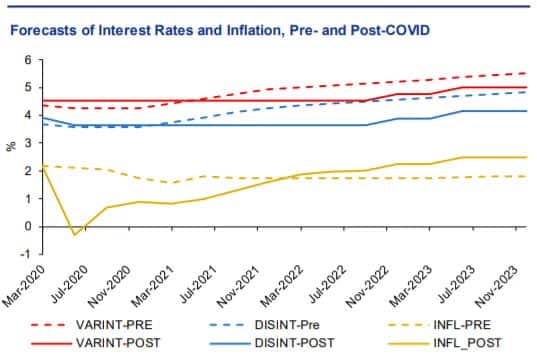

The below graph indicates the projections for Variable Mortgage Interest Rates (VARINT), Discounted Variable Mortgage Interest Rates (DISINT), and Inflation (INFL), determined by KPMG’s macroeconomic forecasts published in December 2019 before the estimated impacts of the COVID-19 pandemic, and after the first 12 months of having COVID on Australian shores, at March 2021.

The current predictions estimate that from mid-2022, mortgage lending rates and inflation will begin to rise, in line with increased wholesaler borrowing costs in the banking sector.

Lastly, in terms of investor participation, there are very similar assumptions from the Pre-COVID-19 and Post-COVID-19 scenarios, as KPMG has outlined that the risk profile of investing in property as opposed to different asset classes has not been altered due to the pandemic.

All of these variable factors have contributed to the change in market sentiment, which has seen every single capital city property market grow at a rate far beyond expectations, with more to come until December 2023 according to the KPMG analysis.

Perth and Hobart are predicted to be the biggest beneficiaries, achieving approximately 35% in each market, with previous predictions of around 30 and 25% respectively. Melbourne and Sydney aren’t far away, with estimations of up to 25% growth, with previous predictions indicating around 18 and 13% respectively. Even Darwin, a market previously predicted to fall in value, is estimated to grow close to 5% to the end of 2023.

For a full breakdown of these market predictions, you can see the pre-COVID & post-COVID market predictions below.

It’s not too late to capitalise on this predicted growth that will take place until the end of 2023 across every capital city.

These unique market conditions have given investors an excellent opportunity to leverage their financial standing and build for their future.

If you’re interested in learning how you could best utilise these favourable conditions, please request a strategy session using the form below, where you will have the opportunity to sit down with one of AllianceCorp’s renowned Senior Property Wealth Planners for a complimentary bespoke session, fully customisable to your financial situation.