[vc_row type=”full_width_background” full_screen_row_position=”middle” column_margin=”default” equal_height=”yes” content_placement=”middle” column_direction=”default” column_direction_tablet=”default” column_direction_phone=”default” bg_color=”#f8f8f8″ scene_position=”center” top_padding=”3%” bottom_padding=”0%” top_padding_phone=”10%” bottom_padding_phone=”5%” text_color=”custom” custom_text_color=”#3e3b3d” text_align=”left” row_border_radius=”none” row_border_radius_applies=”bg” overlay_strength=”0.3″ gradient_direction=”left_to_right” shape_divider_position=”bottom” bg_image_animation=”none” shape_type=””][vc_column column_padding=”no-extra-padding” column_padding_tablet=”inherit” column_padding_phone=”inherit” column_padding_position=”all” column_element_spacing=”default” background_color_opacity=”1″ background_hover_color_opacity=”1″ column_shadow=”none” column_border_radius=”none” column_link_target=”_self” gradient_direction=”left_to_right” overlay_strength=”0.3″ width=”1/1″ tablet_width_inherit=”default” tablet_text_alignment=”default” phone_text_alignment=”default” bg_image_animation=”none” border_type=”simple” column_border_width=”none” column_border_style=”solid”][vc_column_text]The RBA’s latest decision to increase interest rates to 0.35% has come as a huge shock to many Australians, particularly before the Federal election on 21st May.

But is this really as much of an ordeal as the media is making it out to be?

To cut through the misconceptions, we sat down with our research partner, Chief Economist of My Housing Market, Dr Andrew Wilson to provide some perspective on how this will affect Australians and most importantly, the impact on our investors.

Understanding Inflation

Inflation refers to the general increase in prices of goods and services in an economy.

When the general price level rises, each unit of currency buys fewer goods and services; consequently, inflation results in decreased purchasing power of money.

Due to a number of ‘one-off’ events that occurred in the last two years, including the several stimulus packages offered by the Australian Government, the shortage of labour/materials caused by the effects of COVID-19, the price of oil and the financial impacts derived from the Ukraine War, the latest report from ABS revealed that Australia’s inflation rate increased to 5.1% – the highest it has been since the 1980s.

In an effort to halt further increases and impacts on other sectors as witnessed during the 1980s, the RBA intervened sooner than anticipated and lifted interest rates to 0.35%.

The Logic Behind the RBA’s Rate Rise

The shock behind the RBA’s decision was not so much due to the rate rise itself, but rather the rate at which it increased. With most expecting a rate rise of 0.15, lifting interest rates to 0.25%, the RBA lifted considerably to 0.35% in a bold effort to reduce inflation.

Despite the RBA’s consistent position that it would await a period of clearly high wages growth before tightening monetary policy, the Bank stated that “while aggregate wages growth was subdued during 2021 and no higher than it was prior to the pandemic, the more timely evidence from liaison and business surveys is that larger wage increases are now occurring in many private-sector firms,” which will be confirmed on the latest wages data expected on the 18th of May.

The RBA has made clear that they will continue to increase interest rates until they see inflation ease. Globally, the inflation rate has risen sharply to well over 6%, including the US at 8.7% and the UK at 7%, so with Australia’s inflation rate at 5.1%, the RBA intends to curb inflation increases to avoid further impacts.

Wages Growth and Unemployment

The latest data shown by the Australian Bureau of Statistics demonstrated a 0.7% wage growth over the December quarter, achieving an annual rise of 2.3% – significantly below the RBA’s benchmark of 3 or 4 per cent, or the 3.9% recorded when rates last increased in 2010.

With unemployment at an all time low of 4.0% and 200,000 immigrants set to return to Australia by July, Dr. Wilson believes there will be less pressure on wages growth to achieve the 4% benchmark in the near future, but will start to see results in the longer-term.

Immigration Return and Vacancy Rates

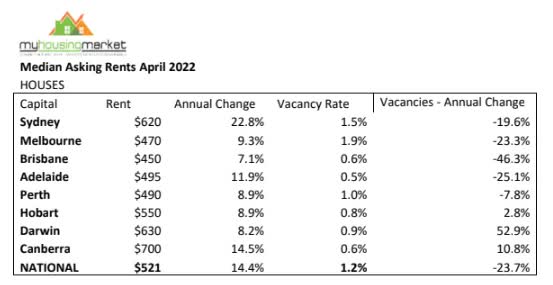

The national rental vacancy rate fell to 1.2% over April, with all capital cities now operating in a landlord’s market.

Vacancy rates in Sydney (1.5 per cent), Canberra (0.6), Brisbane (0.6) and Adelaide (0.5) have reached their lowest point since 2017, while Sydney and Melbourne also experienced the biggest monthly fall at 1.5 per cent and 1.9 per cent respectively.

[/vc_column_text][vc_row_inner column_margin=”default” column_direction=”default” column_direction_tablet=”default” column_direction_phone=”default” text_align=”left”][vc_column_inner column_padding=”no-extra-padding” column_padding_tablet=”inherit” column_padding_phone=”inherit” column_padding_position=”all” column_element_spacing=”default” background_color_opacity=”1″ background_hover_color_opacity=”1″ column_shadow=”none” column_border_radius=”none” column_link_target=”_self” gradient_direction=”left_to_right” overlay_strength=”0.3″ width=”1/1″ tablet_width_inherit=”default” bg_image_animation=”none” border_type=”simple” column_border_width=”none” column_border_style=”solid”][image_with_animation image_url=”17344″ animation=”Fade In” hover_animation=”none” alignment=”center” border_radius=”none” box_shadow=”none” image_loading=”default” max_width=”100%” max_width_mobile=”default”][vc_column_text]With the demand of rental homes increasing, the easing of COVID restrictions and the return of immigrants and international students, Dr Wilson says this is set to exacerbate an already severely undersupplied rental market.

The short term method to address this? Increase housing supply. Leveraging the several incentives recently announced by the Australian Government, this has created a great opportunity for both first home buyers and investors to get into the market.

Housing Market Impacts

House Prices

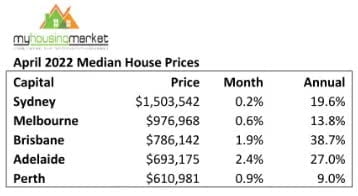

According to Dr Wilson, the latest interest rate rise is set to have little impact on the Australian property market.

According to one of his latest reports, Sydney and Melbourne house prices were flat over April achieving a growth rate of 0.2% and 0.6% respectively, while markets such as Adelaide and Brisbane continued to show stronger results at 2.4% and 1.9%.

[/vc_column_text][/vc_column_inner][/vc_row_inner][image_with_animation image_url=”17359″ animation=”Fade In” hover_animation=”none” alignment=”center” border_radius=”none” box_shadow=”none” image_loading=”default” max_width=”100%” max_width_mobile=”default”][vc_column_text]Moving forward, the outlook for house prices remains relatively positive although the record prices achieved last year will not be repeated as rising affordability barriers have diminished buyer capacity.

Increased Housing Demand & Rental Price Hikes

With rental vacancies at an all time low, combined with the return of immigration and international students, housing demand and rental prices, particularly across Melbourne and Sydney is set to skyrocket.

All capitals have recorded drastic increases over the last 12 months, with Sydney leading at 22.8%, Canberra at 14.5% and Adelaide at 11.9%.

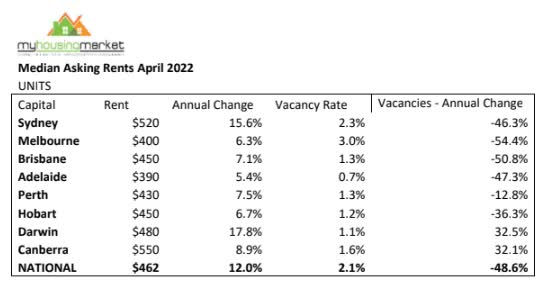

Outside of houses, unit rentals have also recorded strong increases over the past year towards inner city markets, with the national median weekly asking rent at $462 – an annual increase of 12.0%.

Higher rents and strengthening returns for investors is a clear consequence of current supply and demand in both the home and unit rental markets, says Dr. Wilson.[/vc_column_text][image_with_animation image_url=”17346″ animation=”Fade In” hover_animation=”none” alignment=”center” border_radius=”none” box_shadow=”none” image_loading=”default” max_width=”100%” max_width_mobile=”default”][vc_column_text]

What This Means For Investors

Although higher interest rates can have a negative impact on housing affordability, specifically those who are looking to get into the market for the first time, existing mortgage holders, investors and first home buyers are very well-positioned to absorb rate increases.

Demonstrated by a full-employment economy, steadily rising wages, record-level savings rate and the 3% repayment buffer implemented by the banks on new borrowers, Dr Wilson says this has presented a prime opportunity for investors to take advantage of the current market conditions and reap the benefits of both increased demand and high rental returns.

If you are interested in watching the full interview with Andrew Wilson, click on the button below:

So if you’re interested in pursuing your next investment property purchase, simply fill out the form below.

[/vc_column_text][/vc_column][/vc_row][vc_row type=”in_container” full_screen_row_position=”middle” column_margin=”default” column_direction=”default” column_direction_tablet=”default” column_direction_phone=”default” scene_position=”center” top_padding=”2%” top_padding_phone=”0%” bottom_padding_phone=”0%” text_color=”dark” text_align=”left” row_border_radius=”none” row_border_radius_applies=”bg” overlay_strength=”0.3″ gradient_direction=”left_to_right” shape_divider_position=”bottom” bg_image_animation=”none” shape_type=””][vc_column column_padding=”no-extra-padding” column_padding_tablet=”inherit” column_padding_phone=”inherit” column_padding_position=”all” column_element_spacing=”default” background_color_opacity=”1″ background_hover_color_opacity=”1″ column_shadow=”none” column_border_radius=”none” column_link_target=”_self” gradient_direction=”left_to_right” overlay_strength=”0.3″ width=”1/6″ tablet_width_inherit=”default” tablet_text_alignment=”default” phone_text_alignment=”default” bg_image_animation=”none” border_type=”simple” column_border_width=”none” column_border_style=”solid”][/vc_column][vc_column column_padding=”no-extra-padding” column_padding_tablet=”inherit” column_padding_phone=”inherit” column_padding_position=”all” column_element_spacing=”default” background_color_opacity=”1″ background_hover_color_opacity=”1″ column_shadow=”none” column_border_radius=”none” column_link_target=”_self” gradient_direction=”left_to_right” overlay_strength=”0.3″ width=”2/3″ tablet_width_inherit=”default” tablet_text_alignment=”default” phone_text_alignment=”default” bg_image_animation=”none” border_type=”simple” column_border_width=”none” column_border_style=”solid”][vc_column_text]

STRATEGY SESSION REQUEST

[/vc_column_text][vc_column_text]