EXPERTS EXPECT PROPERTY MARKET WILL CONTINUE TO SOAR

Tightening In QLD’s Regional Rental Markets

Property boom tipped to continue into 2022

Property prices are likely to keep roaring higher into further record territory next year, as the Australian economy’s stronger-than-expected recovery continues.

First-home buyers face stiff competition

First-home buyers are beginning to be squeezed out of the housing market by investors who are driving stiff competition at auctions, agents report.

3 REASONS EXPERTS ARE EXPECTING MORE PRICE GROWTH

Experts are predicting that the Australian property market will continue to rise.

Here is some of the commentary we’ve seen this month:

- ANZ forecasts home prices in Sydney will rise 19% and 16% in Melbourne.

- Commonwealth Bank predicts Australia’s house prices will rise 16% over the next two years.

- The NAB forecasts a 16% rise for Melbourne home prices in 2021

- Louis Christopher, founder of SQM Research says that the evidence “suggests the market is going to continue to go up from here; particularly for free-standing houses.”

- Shane Oliver, chief economist at AMP Capital, expects property prices could rise as much as 18% by the end of the year.

In the last few months alone, we have seen some extraordinary results in the market:

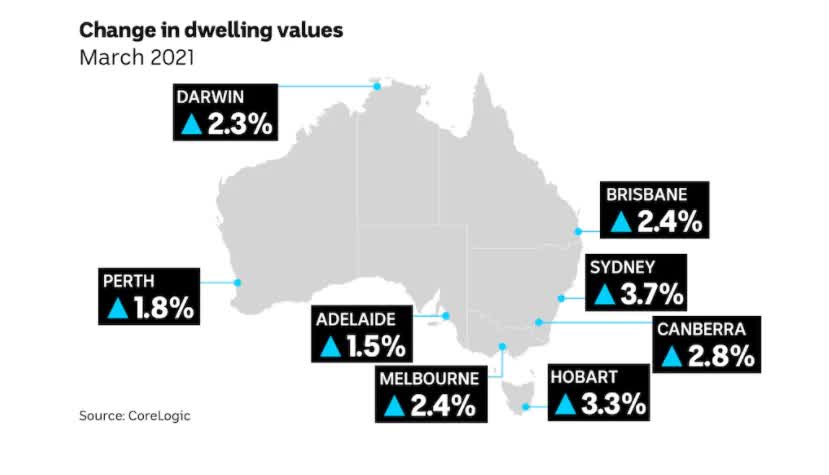

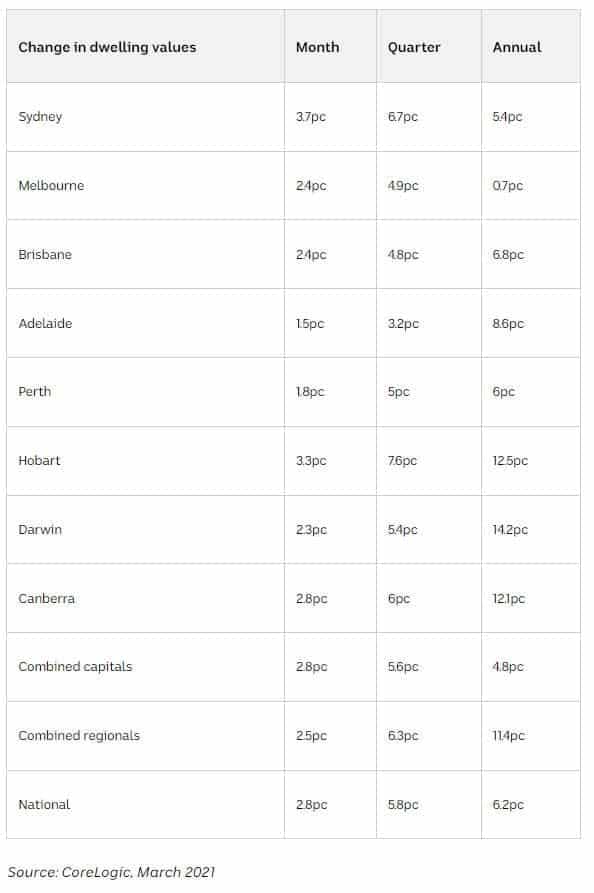

The highest quarterly growth rate since November 1988 (the three months to May). National rent values have risen at a rapid 5.6% in the year to May – the fastest annual increase since February 2009.

All capital cities have recorded a rapid rate of appreciation in home values, ranging from a quarterly rise of 9.3% in Sydney to 3.8% in Perth.

Total listings are down ( -23.8% below the 5-year average) but this is in large part because of how quickly properties are being snapped up: Median time on market was 28 days in the 3 months to May 2021, down from 42 days across the same period in 2020.

There is plenty of positive hypothesizing about the Australian property market for the rest of 2021 and well into 2022. But what is behind this optimism?

Today I’m going to look at three factors which have leading analysts expecting significant growth ahead.

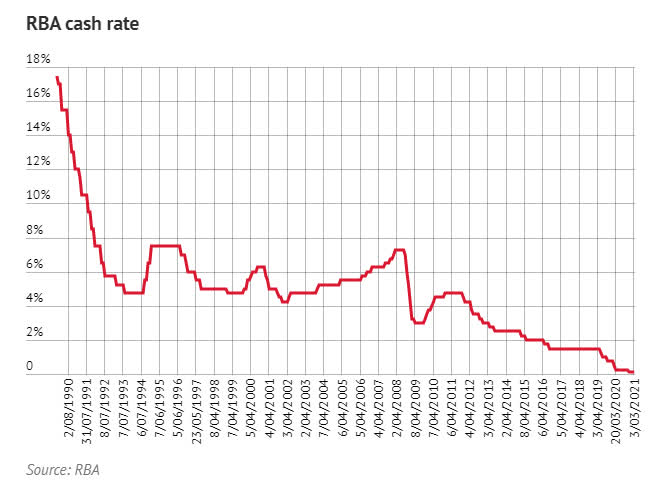

Interest rates

Australia is experiencing record low interest rates. I have spoken about the way interest rates impact investors in this video. Philip Lowe, Reserve Bank governor, has also discussed the impact: “I recognise that low interest rates are one of the factors contributing to higher housing prices.” Lower interest rates make it easier for buyers to enter the market, increasing competition and thus pushing up house prices. Since low interest rates are partially responsible for the increases we have seen – and continue to expect – should we be worried they might change?

CoreLogic’s Eliza Owen thinks it’s “unlikely that we’re going to see any regulatory intervention”. Mr. Low has said that the RBA “will not increase the cash rate until actual inflation is sustainably within the 2.0 to 3.0 per cent target range”. According to RBA targets, inflation is likely to still be under the 2 to 3% range at the end of 2023.

Solid economic recovery

The Australian Bureau of Statistics has posted a second quarter of strong economic recovery in March this year. The ABS reported, “The level of GDP recovered by 3.1% ($14.9 billion) in the December quarter, following the 3.4% ($15.7 billion) rise in the September quarter, but remained 1.1% ($5.6 billion) below December quarter 2019.”

Between May and November 2020, the labour demand increased, reflected in the 96.9% job vacancy increase, showcasing the pace of economic recovery in the September and December quarters.

Treasurer Josh Frydenberg said the economy has recovered 85% of its Covid-induced fall twice as fast as expected. The economy’s role in house pricing was highlighted in a recent interview with Hotspotting Managing Director, Terry Ryder. He noted, “What does inform the future is what’s going on with the economy of the location you are considering.”

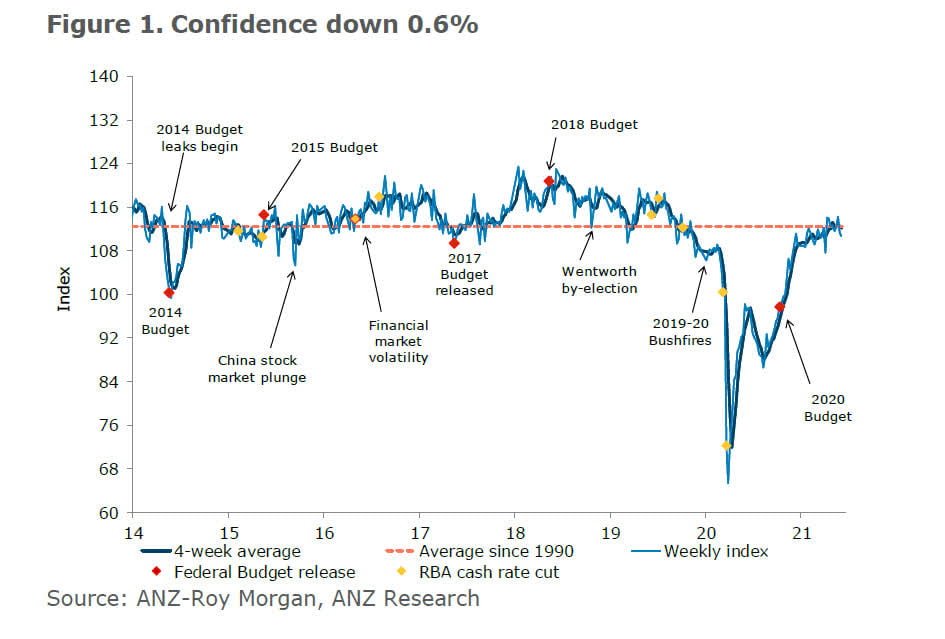

The country’s economic recovery is reflected in consumer sentiment. Domain Group chief economist Andrew Wilson said, “Sentiment is a key driver of the cycle, and a market can be pushed ahead by sentiment, but this is usually picked up in the other indicators first.” This is to say, surging sentiment is often a good indicator of economic recovery.

In Victoria, an extension of Melbourne’s lockdown saw a drop in consumer confidence, said the ANZ-Roy Morgan Consumer Confidence Monthly Report. In the longer term, however, 20% of Australians are expecting ‘good times’ for the economy over the next five years compared to only 13% (down 1ppt) expecting ‘bad times’.

Government grants

The 2021-22 Federal Budget includes multiple grants, designed to help “more Australians realise their goal of home ownership”, said Treasurer Josh Frydenberg.

Here are some of the initiatives:

- The HomeBuilder grant

- The New Home Guarantee scheme

- First Home Super Saver Scheme

- The Family Home Guarantee

The HomeBuilder grant, which was introduced primarily to boost the private construction sector, has been given a 12-month extension. The homebuilder program generated $30bn worth of residential construction activity since June last year, adding fuel to Australia’s record high house prices.

The New Home Guarantee scheme helps first home owners with a deposit as low as 5% build or purchase a new home.

The First Home Super Saver Scheme allows eligible first home buyers to put voluntary super contributions towards a house deposit. While the Family Home Guarantees aims to support single parents with just 2 per cent of a deposit in buying a property.

Many of these grants are designed to make owning a property easier. However, the grants can actually drive prices upwards. CoreLogic’s Eliza Owen says, “As dwelling approvals and commencements surge off the back of HomeBuilder, it is possible that the purchase and construction of new homes could actually become more expensive for first home buyers in the short term.”

Growth sparks affordability fear

These are just three factors which are influencing price growth in the Australian property market. It is also thought we may see changes to responsible lending laws, though there are mixed reports as to whether this will occur. Easing of the lending laws would reduce some of the barriers investors typically face when trying to enter the market.

While house prices grow, fear grows too. Many everyday Australians are concerned they will not be able to participate in the highly competitive market. I have written about Sydney’s extraordinary house prices recently here. Fortunately, there are a range of strategies available to help those on middle or lower incomes grow an investment portfolio.

At AllianceCorp, we have Property Wealth Planners who can evaluate your current financial position to help you determine a realistic plan for achieving long-term wealth.