REGIONAL MARKET NOT SLOWING DOWN BUT CONSIDERED INVESTMENT REQUIRED

Melbournians have slowly begun moving back to the city after flooding the regional Victorian area during the COVID-19 pandemic. Despite this, house prices are forecast to continue rising. However, it is important to understand that not all regional markets are positioned for sustainable long term growth

What’s causing the tightening in regional markets?

Rents in regional markets are growing faster than in capital cities and this could be due to several factors, according to the latest report from CoreLogic.

Australian housing market continues growing into May, despite drop-off fears

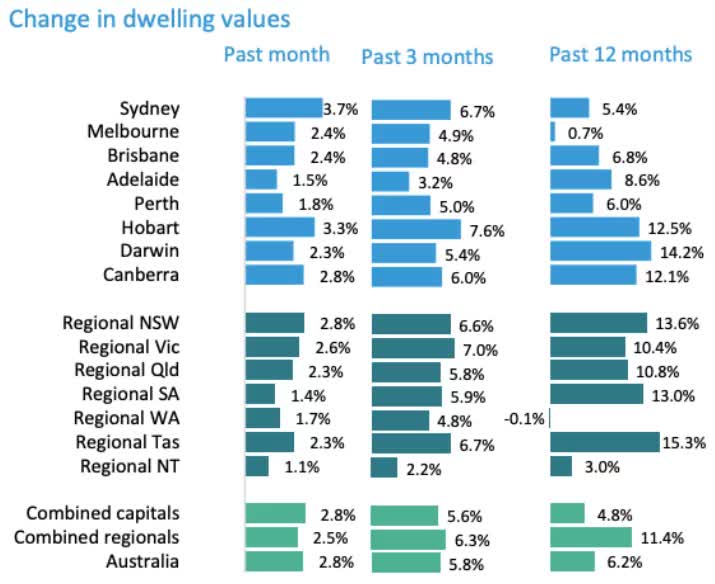

The housing market in Australia has defied expectations and continued to grow in May, despite fears of a drop-off.

Investors to bolster buying rush on the Sunshine Coast

FEATURE ARTICLE REGIONAL MARKET NOT SLOWING DOWN BUT CONSIDERED INVESTMENT REQUIRED

Regional Growth

Melbournians have slowly begun moving back to the city after flooding the regional Victorian area during the COVID-19 pandemic. Despite this, house prices are forecast to continue rising.

Taking a Long Term View

However, it is important to understand that not all regional markets are positioned for sustainable long term growth. Investors must look for properties that show strong fundamentals and key performance indicators to avoid being left with a dud property.

Regional Outperforms Metro

CoreLogic reports have shown that house prices in Victoria’s regional markets have outperformed both that of Melbourne and Sydney. Major cities rose 2% in 2020 while regional Victoria saw a 7% increase.

Why invest in regional Victoria?

Multiple data sources point to regional Victoria as a popular destination for those looking for affordable housing, good rental yields and capital growth.

Affordability

Regional Victoria’s housing prices are considerably more affordable than Metro Melbourne. Ballarat has been an excellent example of the prime conditions this region can offer. It is listed in the top 10 most affordable local government areas in regional, rural and coastal Victoria. Additionally, it is placed at number four for households on the minimum wage with 72.1 percent of properties available. This lower entry barrier is optimal for new homeowners.

In 2018, Ballarat’s median house price was $370K and Wodonga’s was $350K. Prices this low are seldom seen in Metro Melbourne. These cheaper housing prices can make the dream of being a property owner viable for those on a lower income.

Rental yields are higher

Throughout the coronavirus, regional housing values only dropped 0.1 per cent between March and June, reported CoreLogic’s quarterly review. A less optimistic picture is shown when looking at the capital cities, which fell 2% within the same time period, primarily as a result of high rise unit vacancies in the CBD.

CoreLogic data also indicates that gross rental yields are the lowest in Melbourne (2.9 percent) and Sydney (2.7 per cent), though yields in regional Victoria are still relatively healthy at 4.1 percent. Based on this, Those who invest regionally can generally expect better rental yield.

Population growth

For many, regional Victoria presents an opportunity to “get away from the smoke”. It is particularly enticing for those who prefer a quieter, more laid back lifestyle .In the last 6 months, we have seen a significant spike in people moving to regional Victoria. This can be greatly attributed to the COVID-19 pandemic.

According to the ABS, there was a net loss of 3,700 people (loss of people where?) from internal migration in the September 2020 quarter, compared with a loss of 3,000 in the previous quarter and a gain of 2,000 in the September 2019 quarter. The net loss in the September 2020 quarter was the largest quarterly loss since September 1995 (-4,100).

Whilst some of this data is temporary, it does give an insight into the attractive lifestyle proposition the regions offer. Business investment and increasing economic activity which will supply more jobs which will assist with long term demand for housing in some of the major regional markets.

The reports on these sites are often hundreds of pages long and difficult to decipher. Trawling through these reports, for every location you are contemplating, can be immensely time-consuming. That is where partnering with a consultancy can save you hundreds of hours. A quality property investment consultancy selects properties based on hundreds of factors, including current and planned construction.

If you need some help figuring out your next move, speak to a property investment expert. AllianceCorp has a dedicated Research and Acquisitions team with national reach, who have their finger on the market pulse.