To many of us, property investment can seem like a confusing, overwhelming and near impossible task – but yet almost all of us yearn for greater financial freedom to achieve our financial goals. Be it a comfortable retirement, a financial head start, security for your family or simply having the ability to live without compromise, this real life case study is PROOF that you can do exactly that with the right help!

Meet Gary.

Gary was getting close to retirement, had some health issues and was concerned about losing his job.

Confused and overwhelmed by the copious amounts of information, Gary approached AllianceCorp for one thing: EDUCATION.

In his first coaching session with Managing Director, Jason Paetow, Gary learnt:

- More millionaires are created from property than any other asset class

- The banks see property as a low risk investment

- Leverage enables you to purchase multiple properties

- Property provides you with an income that grows

- Your tenants and tax deductions cover all the costs

- Property is actually an easy asset to understand!

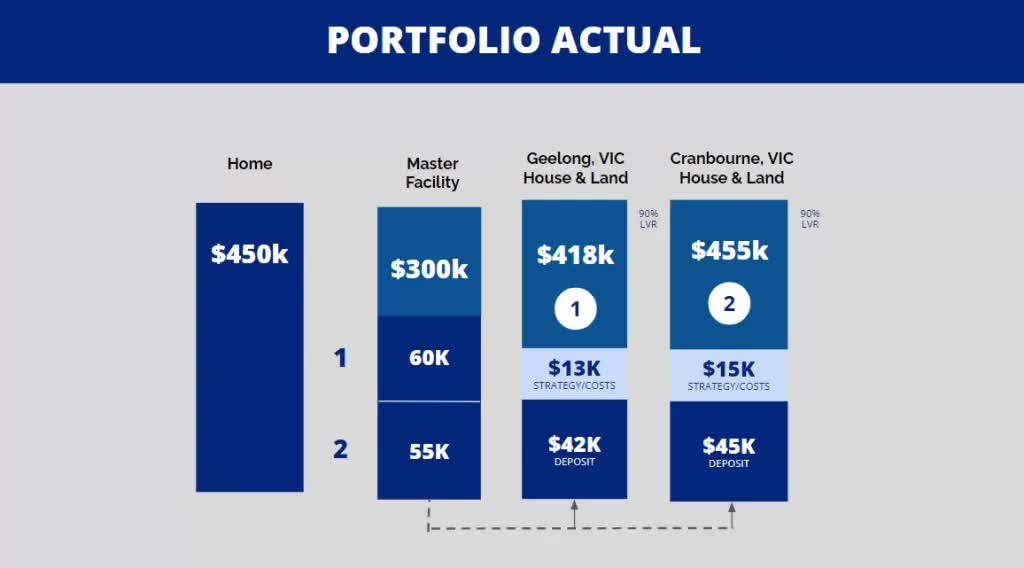

Confident with the information he had been provided and taking on an investor mindset, Gary felt he was ready to begin his property wealth creation journey. With direction from AllianceCorp, he released $300,000 equity from his home and put the funds in a ‘Master Facility’ – a separate account to his personal finances that was solely used to fund his property investment portfolio.

With the initial funds allocated, Gary leveraged a multi-purchase strategy and purchased two properties in Geelong and Cranbourne East, Victoria in 2015.

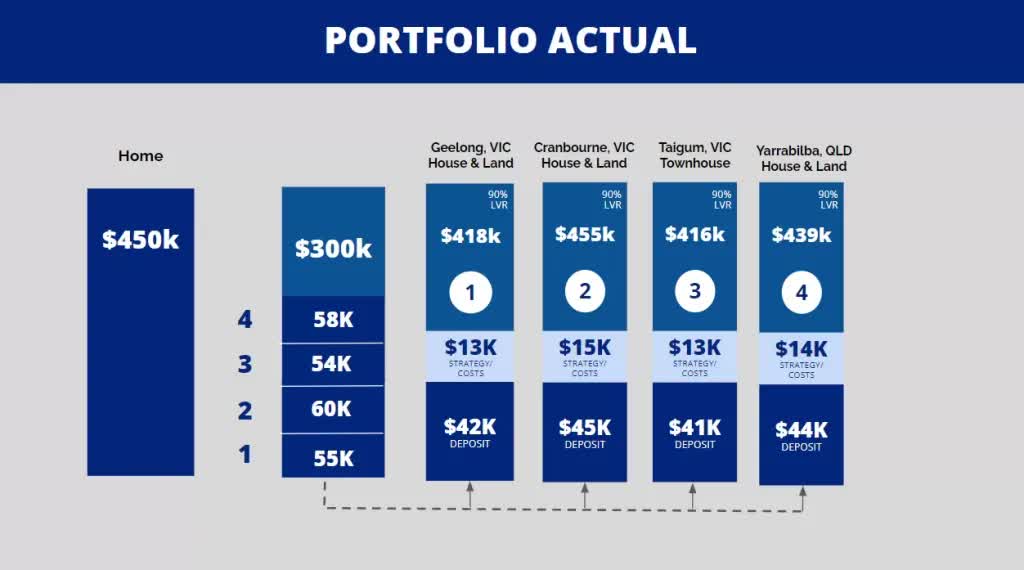

During 2016, Gary used the master facility to purchase another two properties in Taigum and Yarrabilba, Queensland. This was the first point Gary diversified his portfolio as he understood that Australia is made up of hundreds of smaller markets at different stages of the property cycle, and to make a successful property portfolio, you must diversify to capitalise on locations that are going through the ‘boom’ phase of the property cycle.

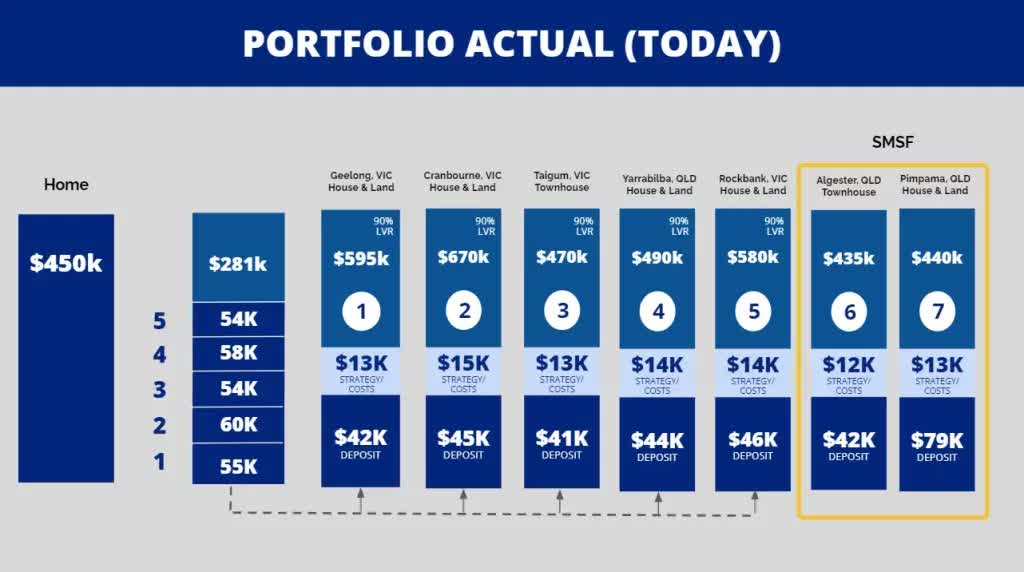

In 2017, Gary repeated the same process and purchased two properties in Rockbank, VIC and Algester, QLD. However, when purchasing the property in Algester, Gary opted to purchase the house through his self-managed superfund (SMSF). Leveraging this method, Gary made his money work harder for him as he learnt that the major advantage of an SMSF is that it has the ability to invest in direct property investments and borrow between 65% to 80% of the value of the property.

Finally in 2019, Gary again leveraged the funds in his self-managed super fund to purchase his last property in Pimpama, QLD – completing his portfolio of a whopping seven properties in just five years. By capitalising on a multi-purchase strategy and leveraging the advice of AllianceCorp, Gary achieved an uplift of $720,000 – putting him in the perfect position to achieve his goal of retiring in Thailand in the very near future.

ACTUAL VS TODAY:

Recently, Gary returned to AllianceCorp to work on his exit strategy to get him to the next milestone. Check out the video below to see how Gary will complete his property investment journey in the coming years.

https://www.youtube.com/watch?v=yOjz_GZ

So if you’re seeking a financial head start, a better life for you and your family or simply having the ability to live without compromise, this is your sign to take a leap of faith and put yourself on the path to financial freedom. Register today for a no-obligation strategy session with one of our esteemed Senior Property Wealth Planners valued at $495 for FREE via the form below!