One of the most prevalent economic casualties of the COVID-19 pandemic has been the dramatic halt to the once widely predicted Australian property boom of recent years.

The property market operates as any other economic market, determined by the age-old forces of supply and demand.

Demand can be effectively split into two categories that make up the whole. The first being the number of people looking to buy an existing home, and the second being the need to build more homes. Hence, population growth is a key component of this underlying demand, as when the population grows, the need to build more homes grows alongside it, roughly at a rate of one dwelling for every 2.5 additional people.

So what happens when the population stops growing at such a rate?

To the beginning of November, Australia’s population had stalled around the 25.7 million mark, an increase of only 35,700 people, which marks the lowest population growth rate since it actually declined in 1916, due to the impact of World War 1. Due to the new COVID-normal world, the natural increase of 131,000 people was largely offset by net overseas migration of 95,300 (from March 2020 to 2021).

This net overseas migration (NOM) has historically been positive in our nation, which is a key driver in our typically strong population growth. Immigration accounted for two-thirds of our population growth prior to the impact of COVID.

It’s really quite incredible that our property market has continued to grow despite this dramatic reduction in population growth, and it truly speaks to the strong market sentiment created as a result of many private & public institution policies that have allowed home buyers and investors alike to get into the market.

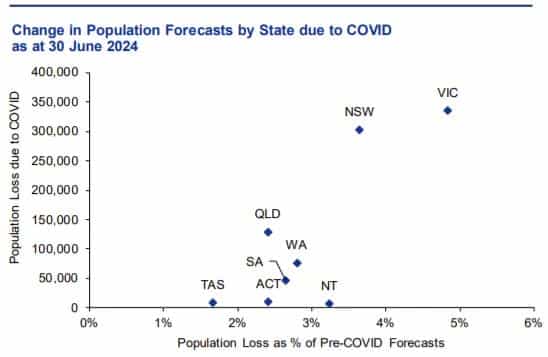

A recent report by the KPMG Economics Group showed the dramatic difference between the predicted pre-COVID population forecast compared to the post-COVID expectation.

The projected population is estimated to be 1.11 million less than it would have been without the COVID-19 pandemic. The state to be most impacted will be Victoria, with a change in population forecast of approximately 5% less, as can be seen below.

The positive news?

Experts are predicting that the re-opening of international borders will set the scene for a true influx of migrants, as the city’s attractive job market is set to entice record numbers back.

The Victorian State Government has continuously emphasised that the fuel for Victoria’s unparalleled economic success is population growth, particularly in Melbourne. Between 2013 and 2019 the state’s economy grew from $364 billion annually to $461 billion, an increase of more than 90 per cent, which lead to the city contributing nearly 40 per cent of the nation’s annual economic growth. In this same time period, the city of Melbourne’s population increased from 4.37 million to 5.08 million, an increase of more than 700,000.

So when this population growth returns in the coming years, what sort of huge economic impact can we expect to flow into the property market?

Herein lies the predictions from numerous economists that the property market still has room to grow in this market cycle, as these impacts of population return have not yet been realised.

The most recent news suggests that Melbourne will overtake Sydney and regain its title as Australia’s largest city by 2027, with a population of more than 5.7 million.

Ben Gearing, Colliers Residential Victoria Director and Leader of the Relationship Management Division recently discussed the city’s economic prospects relying heavily on the re-opening of the international borders, as three key groups will be set to bolster the economy, and in turn, look to continue the rampant growth of the residential property market.

The three groups in question are:

- International Students

- Overseas Investors

- Permanent Migrants

In response to the distressed major universities of Victoria, the State Government released an International Students Arrivals Plan, which will see tens of thousands of international students return to Australia in weekly cycles, starting at the commencement of 2021. This increased demand for rental properties will help to offset the deterrents seen in the market for owning rental properties over the past year or so, which will lead to increases in their respective values.

Additionally, Colliers reported a rapid increase in international buyers, with “more than 1,000 partner agent groups throughout China” who have many buyers with an incredibly strong interest in Melbourne’s new and off-the-plan housing market, both in terms of the apartment market and other residential projects.

This surge in buyer activity will help to grow the value of the residential market even further than the growth seen thus far.

Permanent migrants are set to be welcomed back with open arms, as the State is keen to return to the level of population growth that was to see Melbourne surpass Sydney as the country’s largest metropolitan city.

With an abundance of incentives being put in place, Melbourne’s Deputy Lord Mayor, Nicholas Reece, has called for an increase in annual migration intake from 160,000 to 300,000.

The aim is to “help get the city back on track”.

All of these factors, further shine positive sentiment on the future of the Melbourne, and the wider Victorian property market, as these underlying growth factors are still yet to come to the forefront of an already hot market.

If you’re interested in learning how you could capitalise on this predicted population growth, please feel free to request a strategy session with one of our Senior Property Wealth Planners below, where you can take part in a complimentary, bespoke session, fully customisable to your financial position

REQUEST A STRATEGY SESSION