WHY INVESTORS SHOULD CARE ABOUT MILLENNIALS COMING OF AGE

Changes to demographics can have major repercussions for Australia’s housing market, so they are worth paying attention to. Millennials will become the dominant generation in the workplace between 2020 and 2030, says Cushman & Wakefield’s new report, Demographic Shifts: The World in 2030.

ACT Nixes Stamp Duty For Off-The-Plan Units

Canberrans who are looking to downsize will be able to save thousands of dollars with the recent move of the ACT government to abolish stamp duty for off-the-plan apartments and townhouses.

Southern Redland bay set for infrastructure investment

A Southern Redland bay site has been earmarked for future growth, with the Queensland Government prioritising the area for infrastructure investment to unlock over 5,000 lots, improve land supply and create affordable housing.

Reserve Bank makes July interest rate decision

FEATURE ARTICLE WHY INVESTORS SHOULD CARE ABOUT MILLENNIALS COMING OF AGE

What are demographics and why do they matter? Demographics are statistics about a population and its subgroups. They look at aspects such as age, education, birth and death rates. Changes to demographics can have major repercussions for Australia’s housing market, so they are worth paying attention to. “Demographics is code for ‘futurism’ – you can interpret bigger-picture trends by interpreting demographic trends, and use the findings at a strategy level,” says Bernard Salt, Australia’s leading social commentator.

Millennials Ready to Purchase Property

Here’s the latest demographic shift: More millennials are “coming of age”. As a general rule of thumb, millennials are those born between 1981 and 1996.

Many people who fall within this age bracket are reaching the point where they are ready to purchase their first property. “The Millennial population…represent the most influential age cohort in today’s residential property market,” according to the QBE Australian Housing Outlook Report 2018-2021.

A Surging Workplace Force

Millennials will become the dominant generation in the workplace between 2020 and 2030, says Cushman & Wakefield’s new report, Demographic Shifts: The World in 2030. Millennials are expected to have the fastest growth in net wealth over the 2020 decade. Millennials will have more funds to put towards property purchases. The question is: Where will they be purchasing?

A Shift in Priorities

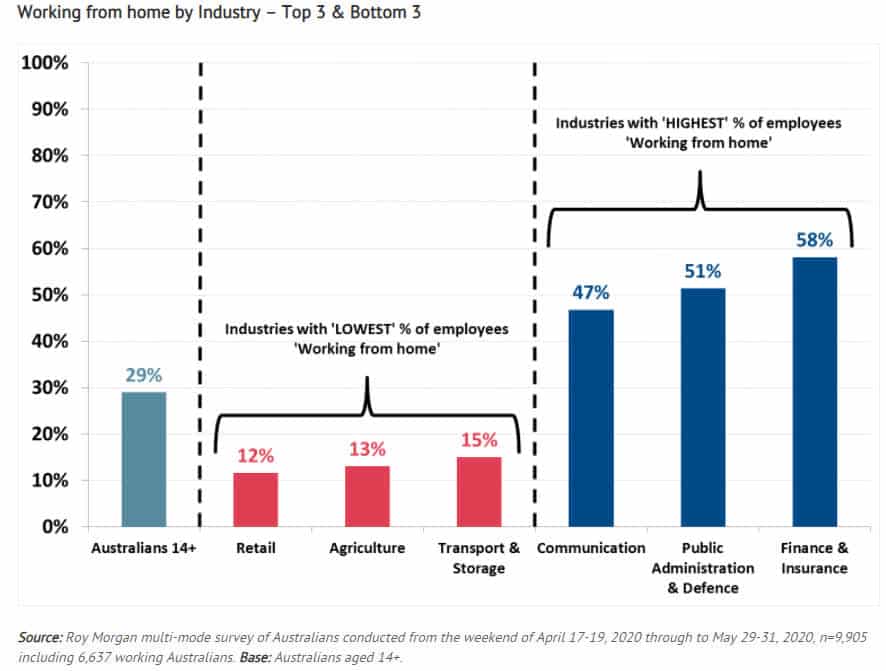

The values of millennials are shifting. So too are their living preferences. All this to say, outer suburbs are likely to see significant growth over the coming years. We’ve seen Australia’s workforce go from about 5% working from home, to around 30% during the lockdowns.

While half of the population is unlikely to remain on zoom conference calls interminably, many disruptions to traditional office dynamics are going to stick around.

Plenty of people will commence hybrid arrangements, where they work from home a few days a week. Consequently, they are likely to place less importance on proximity to the city. Instead, they will want to remain within commuting distance, while they establish themselves in more spacious outer suburb surroundings. Never has a spare room and a garden been at more of a premium, thanks to many of the lockdowns experienced throughout 2020 and continuing in 2021. For this reason, investors should be looking to outer suburb growth corridors.

Millennials Become Parents

For those without children, a spare room may be enough space to conduct business from home. But for those with kids, as Bernard Salt identified, local quiet-zones will be attractive places to remain productive and distraction-free. In these outer suburbs, shared office spaces and amenities, such as gyms, cafes and childcare facilities, will start to pop up.

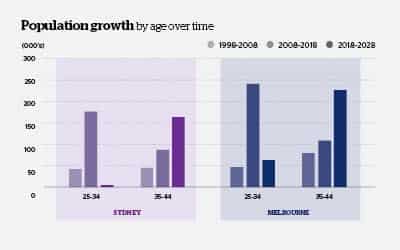

Between 2018 and 2028, Sydney’s 35 to 44-year-old population is set to increase by 162,400 and in Melbourne by 225,700. In Sydney and Melbourne, about 33% of 25-34 year old households have kids. But in the 35 to 44-year-old age group, 68% are made up of families with children.

As millennials age, we’re going to see more demand for houses with more rooms. Bernard Salt says, “What suits you at 31 does not suit you at 38 or 39 when you’ve got two kids.” He predicts that millennials will move past the “hipster phase” of their life cycle and “into family formation and family development.” However, he also stresses it’s possible to invest at the right time in the wrong place. Not all outer suburbs are equal.

While the city will always play a crucial role in commerce, with businesses organising themselves around this central hub, there are changes afoot. A permanent move to remote or hybrid work is likely to see overlooked suburbs boom. This, in conjunction with a migrant influx around 2024, means those suburbs within 100km of the CBD are primed for growth.

If you’d like to know which particular areas will see the most population growth or how you can make a strategic investment in light of these changing demographics, speak to an experienced Property Wealth Planner.