Last week, the Victorian Government announced the introduction of ‘COVID Tax’, an incentive aimed to neutralise the state’s accrued COVID debt over a period of 10 years – estimating $4.7 billion by 2033.

The government expects 860,000 Victorians will be affected, applying primarily to those who own a second property or multiple properties.

WHAT DOES THIS MEAN FOR INVESTORS?

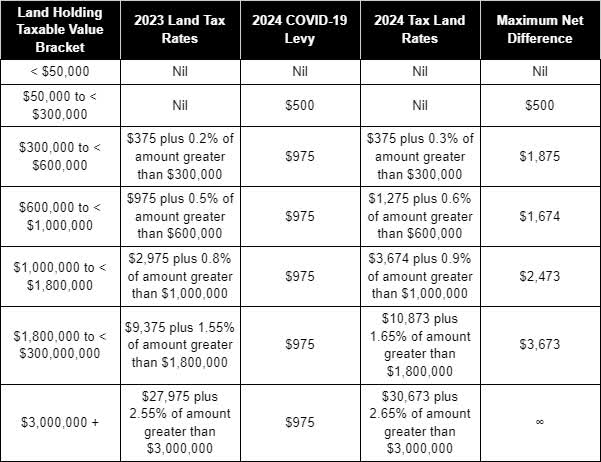

There have been two main changes to the current land tax structure.

The first, is the flat-rate levy. Previously, there was no payable tax for land holdings with a taxable value under $300,000.

Under the new 2024 model, those who own an additional property with a taxable value between $50,000 and $300,000 are subject to a flat-rate levy of $500. Those with land holdings greater than $100,000 are subject to a flat rate levy of $975.

The second is the increase to land tax.

Under the 2024 model, land-owners that own an additional property outside of their Principal Place of Residence may be subject to an increased rate on their payable land tax.

There are no changes to the payable land-tax on land holdings with a taxable value under $300,000. However, land holdings with a taxable value that is greater than $300,000 will be subject to an increase of 0.1% to their respective land-holdings bracket.

For example, the current land-owners with holdings between $300,000 to $600,000 pay an existing rate of $375 (levy) plus 0.2% of the taxable value above $300,000.

As of 2024, this rate will be increased to $375 (levy) plus 0.3% of the taxable value above $300,000.

Take Alice. Alice currently owns:

- Property A, an investment property with a taxable value of $580,000

- Property B, an investment property with a taxable value of $500,000

- Property C, her principal place of residence (PPR)

Alice’s total land tax liability for the following year is calculated by applying the appropriate land tax rate to the total taxable value of the non-exempt land she owns.

She is only assessed on the total taxable value of Property A and Property B, which is $1,080,000 because Property C is Alice’s PPR and is therefore exempt from land tax.

The general land tax rate for land holdings valued from $1,000,000 to less than $1,080,000 is $2,975 plus 0.8% of any amount greater than $1,000,000

Therefore, Alice must pay $3,615 in land tax, calculated as follows:

$2,975 + (($1,080,000 – $1,000,000) x 0.8%) = $3,615

Under the new 2024 structure, Alice will pay:

$975 + ($3,674 + (($1,080,000 – $1,000,000) x 0.9%)) = $5,369

A difference of $1,754 per year pre-tax. It is important to remember that land tax is a tax deductible item.

WHAT IS THE IMPACT IN THE GRAND SCHEME OF THINGS?

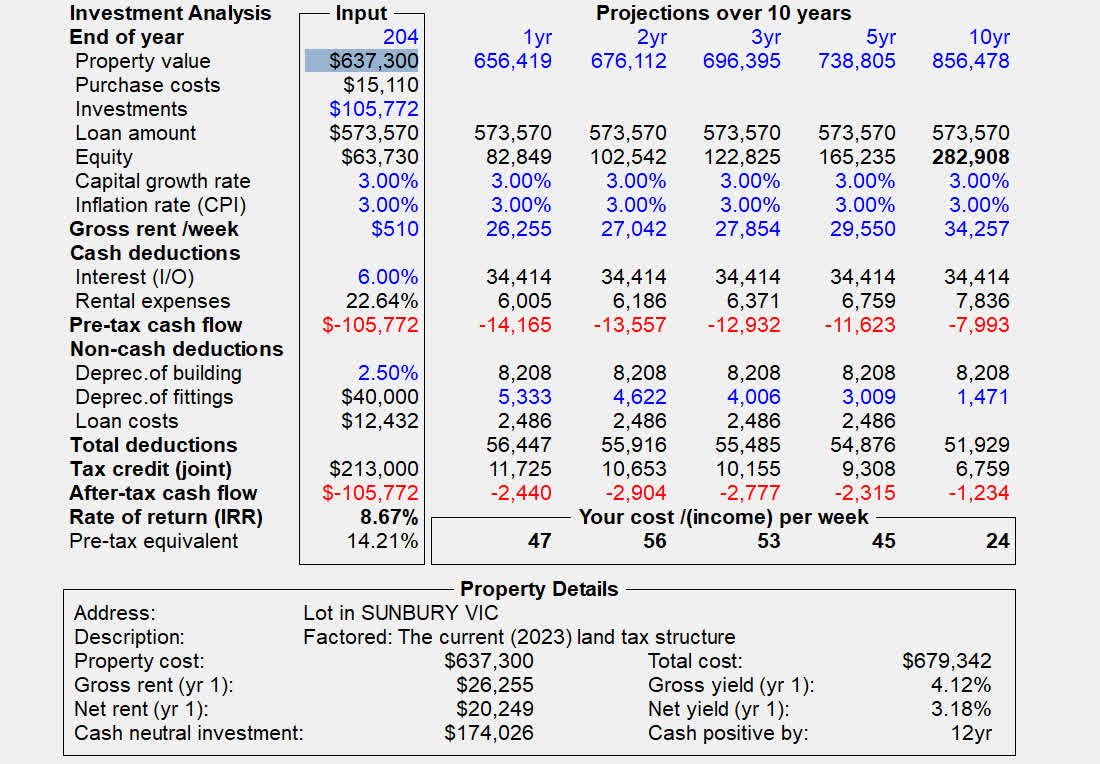

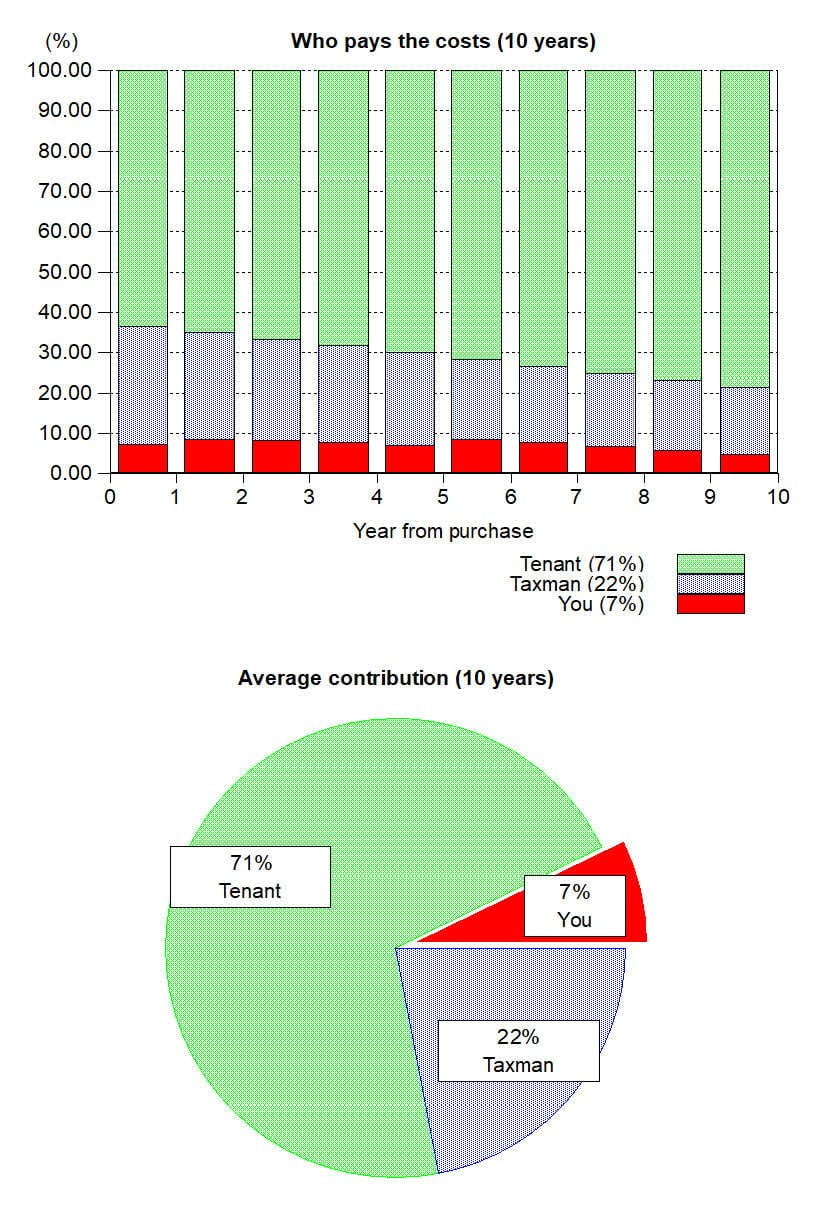

Below outlines a PIA report on a property recently sold by AllianceCorp.

Based on the current tax structures in place, you can see landlords pay an additional $47 per week in the first year after tax.

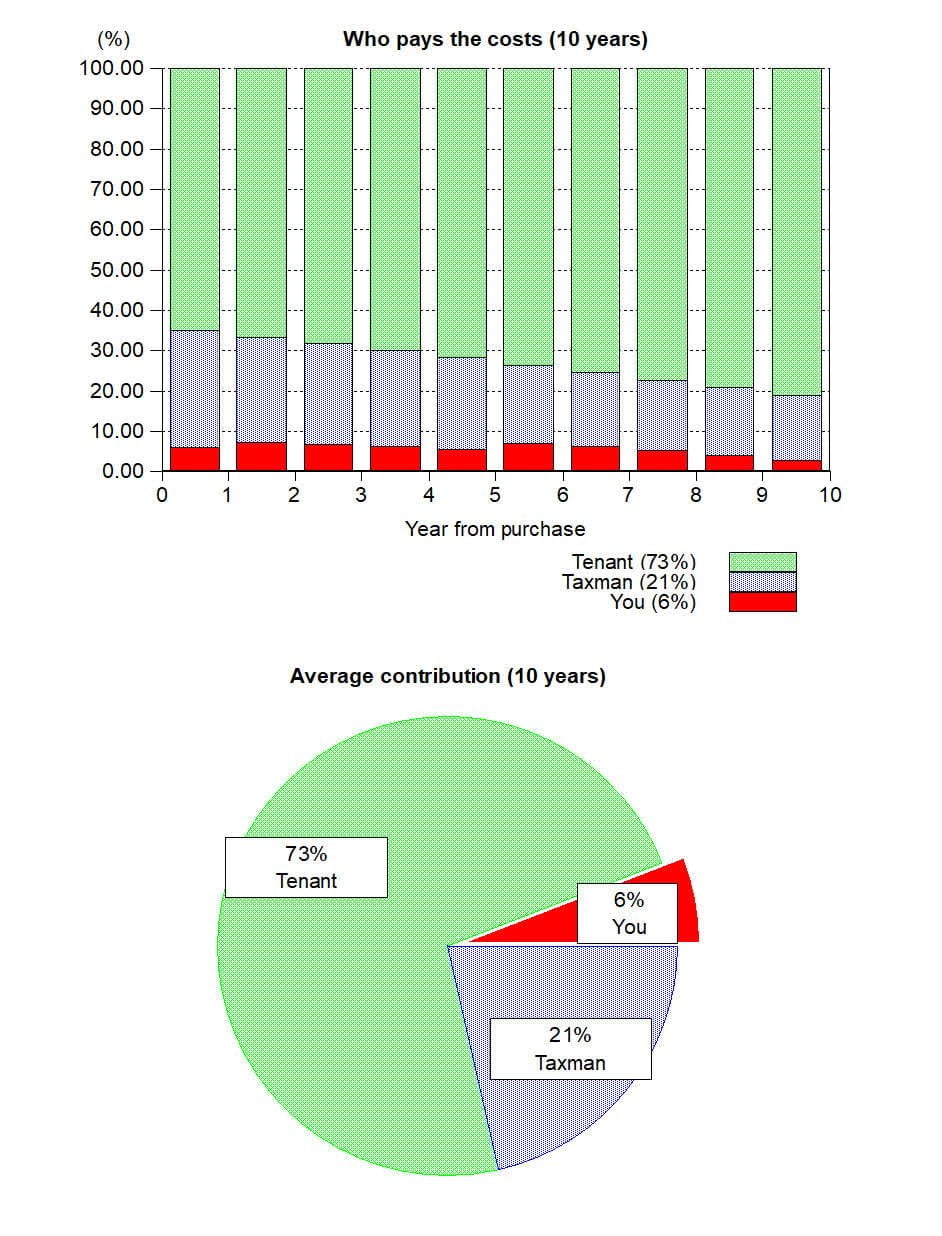

As it stands, landlords contribute a mere 6% of the total costs affiliated with their investment property. The large majority is covered by both the taxman and your tenant.

Current Tax Structures:

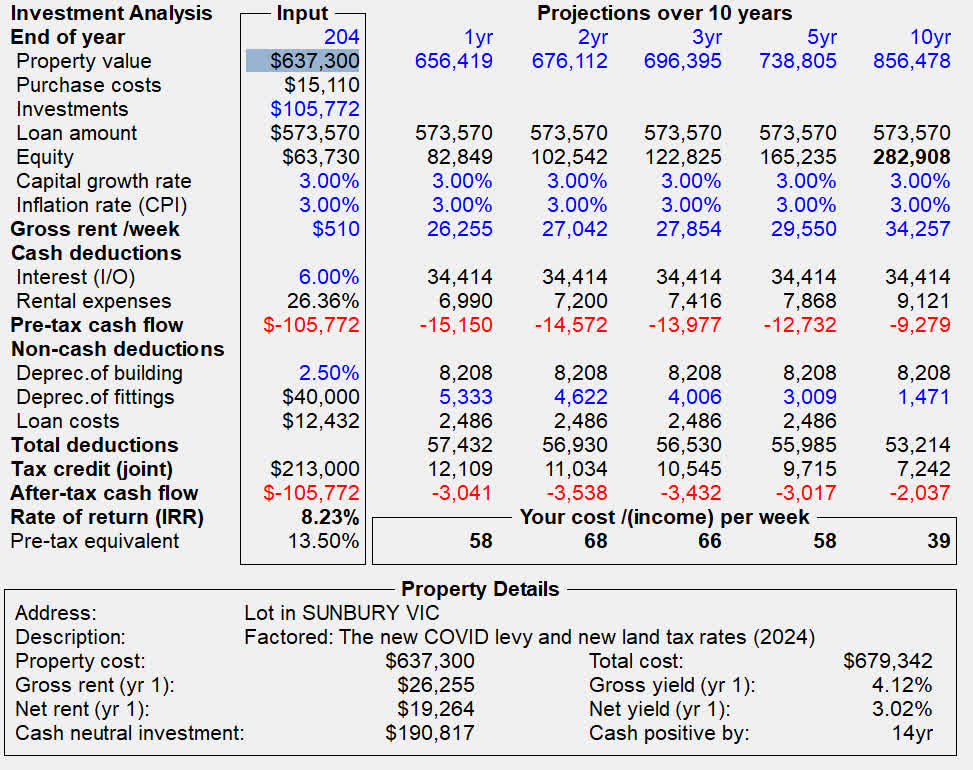

2024 Tax Structures:

Under the new proposed structure, this same property will require the landlord to contribute $58 per week after tax, a difference of $11 – what’s equivalent to two coffees per week, or one lunch!

Lifting the required contribution from the tenant from 6% to 7%, you can see the new tax structures will actually make little to no difference on your finances or your lifestyle.

WHAT YOU SHOULD DO NOW:

With rates expected to be kept on hold for the remainder of the year, confidence will likely return to the housing market from as early as June according to SQM Research, who predicts a 3 to 7 percent increase in capital growth for the Australian property market in 2023.

While there’s no denying this is a challenging time for some, there is a highly optimistic outlook for the months ahead, and for those who have a property portfolio or are interested in starting one, the team at AllianceCorp highly encourage you to buy the dip and take advantage of the incredible prospects on the horizon.

When ‘buying the dip’, investors access the benefits of buying at a time where there is:

- Reduced competition

- Room for negotiation

- Greater choice of properties

- More attainable price points

- Security of knowing that property prices always increase over the longer-term – even if it’s currently stagnant!

So whether you’re actively looking to invest or are sitting on the fence, we highly encourage you request a no-obligation strategy session with one of our Senior Property Wealth Planners valued at $495 totally free by filling out the form below.