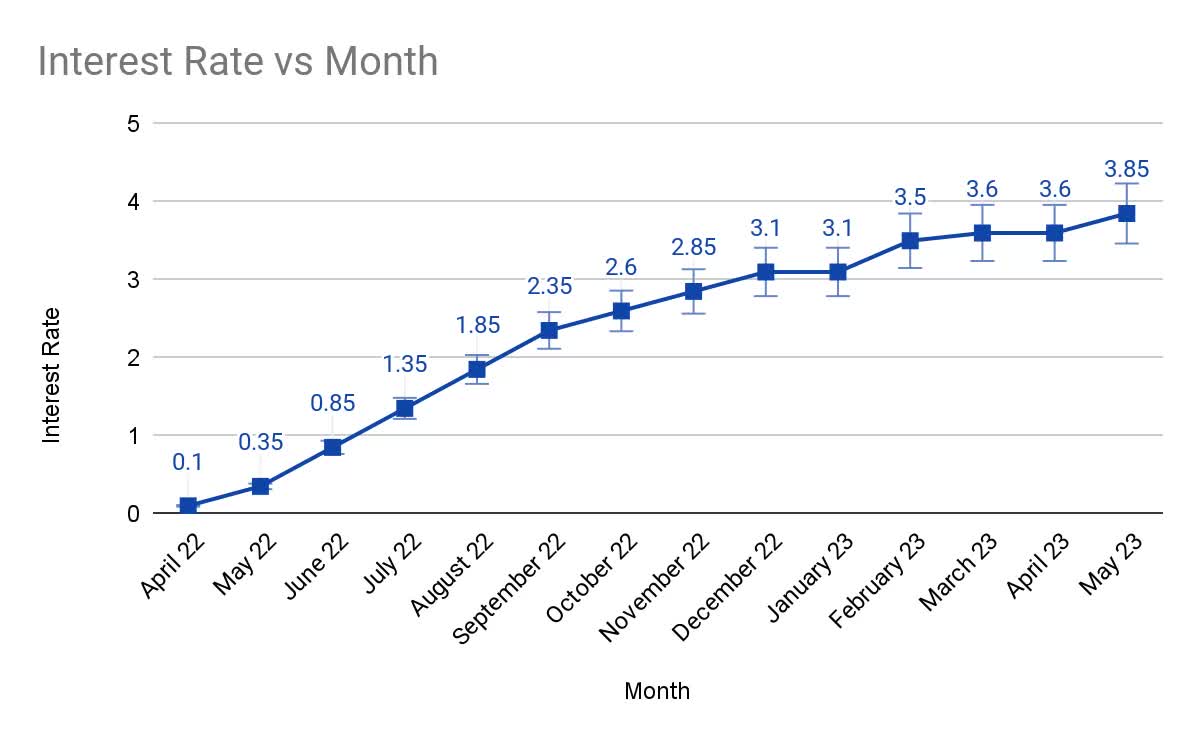

This week, we experienced the 11th rate rise in 12 months, starting at 2.85% in April of 2022 and now sitting on 3.85%

It’s no secret this has created additional pressures on Australian households, however changing interest rates are a natural part of property cycles.

Having experienced a major property boom during 2020 and 2021, we are now enduring a downturn period which has historically shown us that this results in increased rental yields, slower/stagnant buyer activity and overall consumer confidence.

BUT, there is light at the end of the tunnel.

Earlier this year Westpac announced their prediction of seven rate cuts during 2024-25 with inflation reach 2-3% by mid 2025.

They believe interest rates are expected to stagnate in second half of 2023, which will bring down the inflation rate to 4% by the end of the year.

Predicted Timelines:

- April 2023: Increase to 3.85 per cent

- May 2023: Increase to 4.1 per cent

- March 2024: Cut to 3.85 per cent

- June 2024: Cut to 3.6 per cent

- September 2024: Cut to 3.35 per cent

- December 2024: Cut to 3.1 per cent

- March 2025: Cut to 2.85 per cent

- June 2025: Cut to 2.6 per cent

- September 2025: Cut to 2.35 per cent

So what does this mean in the grand scheme of things?

Markets are now normalising:

Property markets are beginning to normalise, and the recovery trend is expected to continue. After falling by 9.1% between May 2022 and February 2023, housing values seem to have bottomed out and have posted a second consecutive monthly rise. The CoreLogic Home Value Index (HVI) increased by half a percent in April, following a 0.6% lift in March, and is now 1.0% higher over the past three months.

According to Tim Lawless, CoreLogic’s Research Director, the housing market has passed an inflection point. “Not only are we seeing housing values stabilising or rising across most areas of the country, a number of other indicators are confirming the positive shift” he said.

Interest rate increases are slowing:

One factor contributing to the market recovery is that interest rate increases are slowing, as noted by Westpac. Additionally, stock on the market is tightening, with total property listings dropping from 265,116 in January 2021 to 215,144 in January of this year, according to SQM Research.

Rental income continuing to rise:

Furthermore, rental income is continuing to rise, with Domain reporting a 13% increase in weekly rents year on year to March 2023. Rental income increases are helping to offset rising interest rates, thus providing investors with strong returns.

Capital growth:

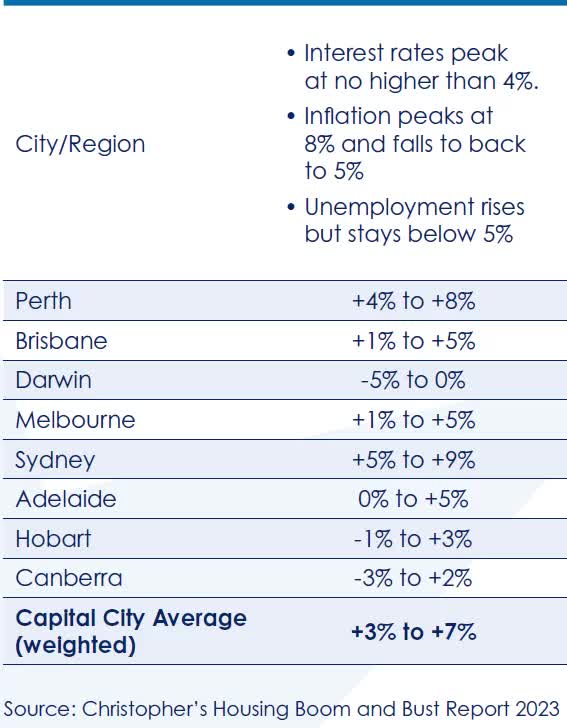

With rates expected to be kept on hold for the remainder of the year and possibly cut at the end of the year, confidence will likely return to the housing market from May/June, according to SQM Research, which predicts a 3 to 7 percent increase in capital growth for the Australian property market in 2023.

While this is a challenging time for many, there is an optimistic outlook for the months ahead, and for those who have a property portfolio or are interested in starting one, I encourage you to buy the dip and take advantage of the incredible prospects on the horizon!

Simply request a complimentary strategy session via the form below to find out how you can capitalise on these opportunities or contact your Property Wealth Planner directly.